32+ Wisconsin Take Home Pay Calculator

Web Wisconsin Income Tax Calculator 2021. Supports hourly salary income and.

Paycheck Calculator Take Home Pay Calculator

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin.

. Web The state income tax rate in Wisconsin is progressive and ranges from 354 to 765 while federal income tax rates range from 10 to 37 depending on your income. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web The Wisconsin Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount. Your average tax rate is 1198 and your. If this employees pay frequency is weekly the calculation is.

Fill out our contact form or call 877 729-2661 to speak with Netchex. Web Wisconsin Hourly Paycheck Calculator. Web Ad Compare 10 Best Paycheck Makers for 2023.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take. Based on an annual salary. The first 11770 of taxable income is taxed at 4.

Ready for a live demo. This free easy to use payroll calculator will calculate your take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent.

Web Wisconsin Paycheck Calculator. Web Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2023 tax year on Jan 01 2023. Web 474 rows How much do you make after taxes in Wisconsin.

If you make 70000 a year living in the region of Wisconsin USA you will be taxed 12843. Simply enter their federal and state. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

It can also be used. Just enter the wages tax withholdings and other. Web The taxable wage base for unemployment insurance in Wisconsin is 14000 for 2022.

Web Do you want to get more for your business with Payroll Benefits HR made easy. Based on an annual salary. Web Use ADPs Wisconsin Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Wisconsin state income tax is a graduated tax which means that the percentage of tax owed increases as income increases. That means only the first 14000 of each employees pay is taxable.

Fillmore County Journal 4 28 14 By Jason Sethre Issuu

Pdf Longer Run Distributive Cycles Wavelet Decompositions For The Us 1948 2011

2023 Gross Hourly To Net Take Home Pay Calculator By State

Cross Creek Ranch 60 In Fulshear Tx New Homes By Tri Pointe Homes

Versatile Tools For Understanding Electrosynthetic Mechanisms Chemical Reviews

Wisconsin Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Wisconsin Salary Calculator 2023 Icalculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

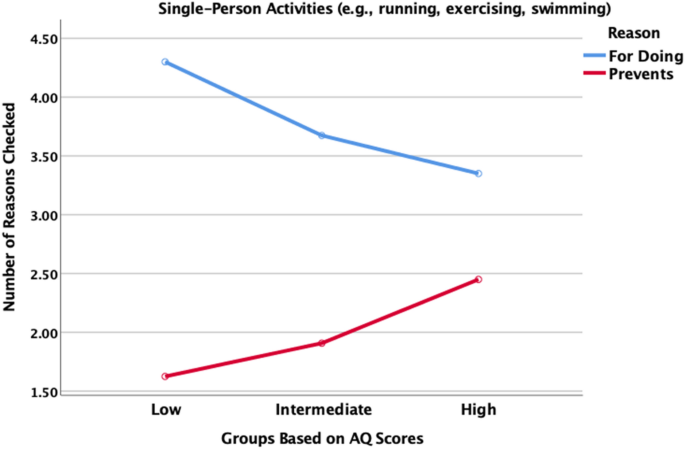

Autism Traits Predict Self Reported Executive Functioning Deficits In Everyday Life And An Aversion To Exercise Springerlink

4635 Mix Way Loon Lake Wa 99148 Mls 202217029 Redfin

Wisconsin Payroll Calculator Calculate Net Paycheck State And Federal Taxes Estimate Salary In Wisconsin

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

1010 Greenfield Dr Cheney Wa 99004 5364 Mls 202310168 Redfin

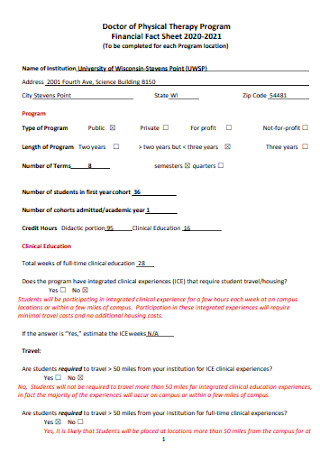

32 Sample Financial Fact Sheets In Pdf Ms Word

17109 East Cataldo Avenue Greenacres Wa 99016 Compass

Walsh Townhomes In Fort Worth Tx New Homes By Perry Homes